Understanding BlackRock Holdings Value: Unlocking Insights Into The World's Largest Asset Manager

BlackRock Holdings Value is a term that resonates deeply within the world of finance and investments. As the world’s largest asset manager, BlackRock Inc. oversees trillions of dollars in assets, making it a pivotal player in the global economy. The company’s holdings span a wide array of industries, geographies, and asset classes, offering valuable insights into market trends and financial stability. Understanding the value of BlackRock's holdings is crucial for investors, policymakers, and industry professionals alike.

With its vast portfolio, BlackRock wields significant influence in shaping financial markets. From equities and fixed-income securities to alternative investments, the firm's holdings reflect both strategic decision-making and market dynamics. By analyzing BlackRock Holdings Value, one can gain a clearer picture of how this financial giant navigates opportunities and risks in an ever-evolving economic landscape.

In this article, we delve into the intricacies of BlackRock Holdings Value to uncover what makes this asset management titan so impactful. Whether you're an individual investor, a financial analyst, or someone curious about global finance, this comprehensive guide offers valuable insights. From understanding BlackRock’s investment strategies to exploring its top holdings, we leave no stone unturned in our quest to decode its immense influence.

- What Happened To Ambroses Parents

- What Is The Most Rare Female Voice

- Which Country Is Jules From

- What Kind Of Car Does Danny Devito Drive

- Do Devin And Virginia Get Married

Table of Contents

- What is BlackRock?

- Why is BlackRock Holdings Value Important?

- How Does BlackRock Structure Its Portfolio?

- Top BlackRock Holdings in 2023

- BlackRock Holdings Value: Impact on Global Markets

- How to Analyze BlackRock Holdings?

- Investment Strategies Used by BlackRock

- BlackRock and ESG Investments

- What Are the Risks Associated with BlackRock Holdings?

- How Has BlackRock Holdings Value Evolved Over Time?

- BlackRock vs. Other Asset Managers

- The Role of Technology in BlackRock Holdings

- How Can Investors Benefit from BlackRock Holdings?

- Future Outlook of BlackRock Holdings Value

- Frequently Asked Questions About BlackRock Holdings

What is BlackRock?

BlackRock Inc. is an American multinational investment management corporation headquartered in New York City. Founded in 1988, the company has grown to become the world's largest asset manager, overseeing over $9 trillion in assets under management (AUM) as of 2023. BlackRock offers a wide range of investment products, including mutual funds, exchange-traded funds (ETFs), and alternative investments, catering to both institutional and retail investors.

Why is BlackRock Holdings Value Important?

The importance of BlackRock Holdings Value lies in its scale and influence. As a major institutional investor, BlackRock's decisions can impact stock prices, bond yields, and even government policies. Understanding the value of its holdings provides insights into market trends and helps investors align their strategies with those of this financial powerhouse.

How Does BlackRock Structure Its Portfolio?

BlackRock employs a diversified investment approach to structure its portfolio. By balancing risks and returns across various asset classes, the firm aims to achieve long-term financial goals for its clients. Here's a breakdown of its portfolio structure:

- Is Jordan Romano Married

- Who Is Jeremy Robinson The Lawyer

- Are Alina And Steven Still Married

- Who Is The Settlement Attorney

- How To Use Google Jules Ai

- Equities: A significant portion of BlackRock’s holdings includes stocks from various industries.

- Fixed Income: Bonds and other fixed-income securities form another key component.

- Alternative Investments: Real estate, private equity, and hedge funds are also part of its diversified portfolio.

- ESG Investments: Environmental, Social, and Governance (ESG) criteria are increasingly integrated into their investment decisions.

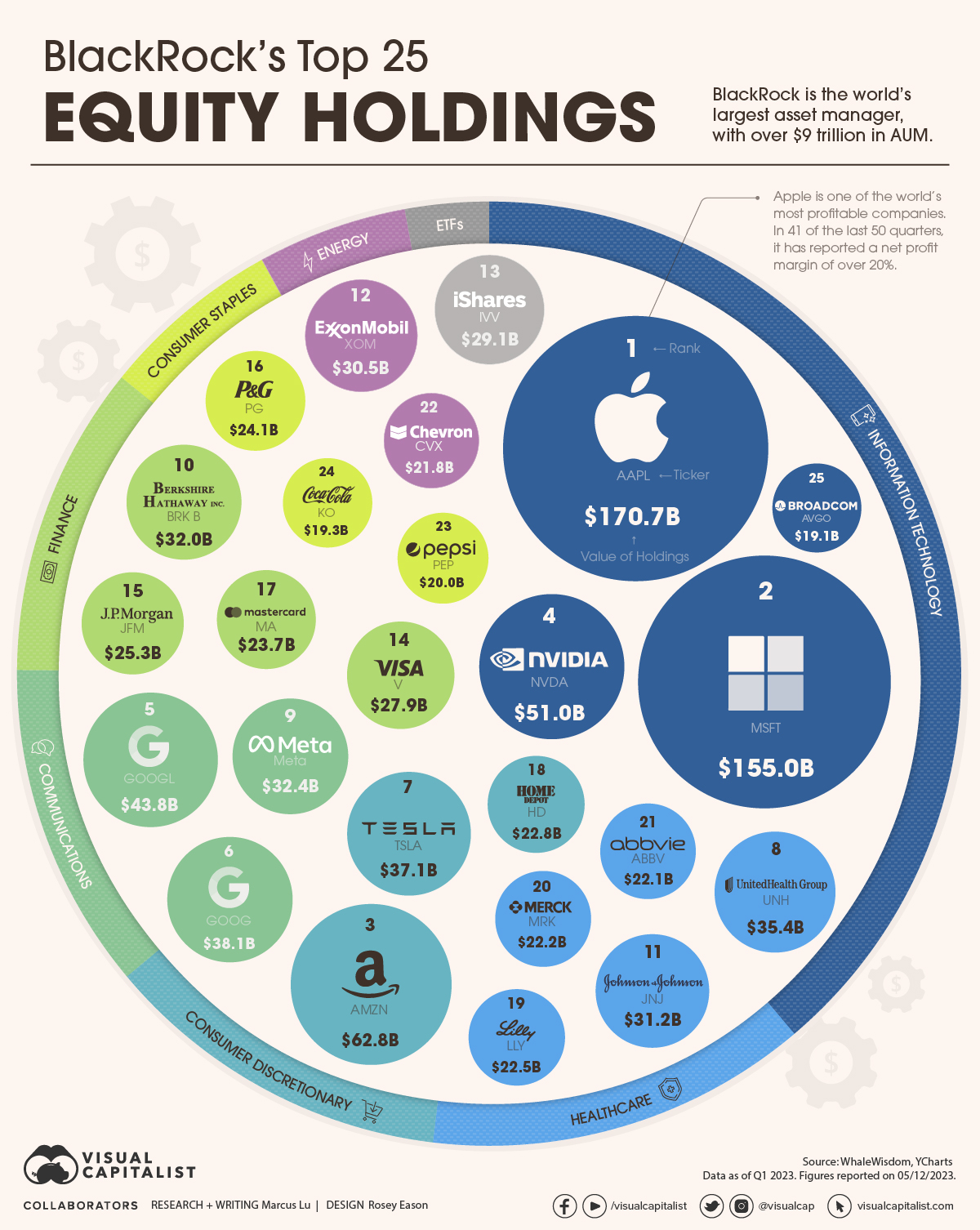

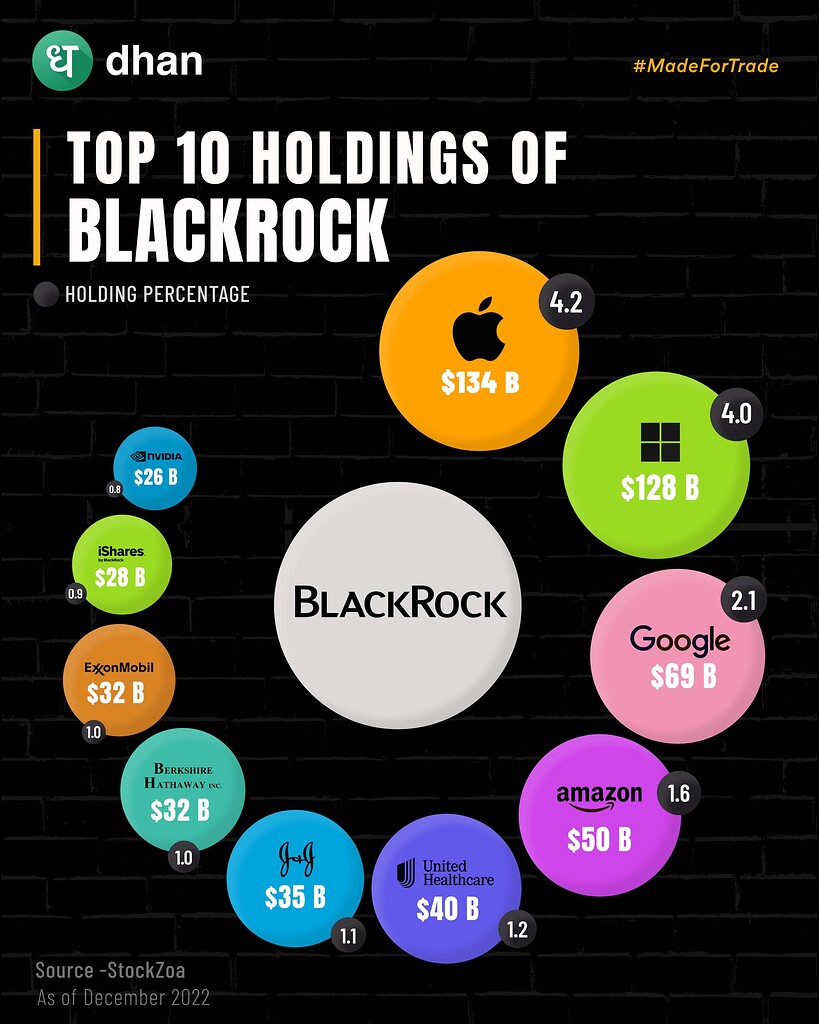

Top BlackRock Holdings in 2023

As of 2023, some of BlackRock's top holdings include companies in technology, healthcare, and finance sectors. Key investments often include giants like Apple, Microsoft, and Amazon, reflecting its confidence in high-growth industries. These holdings are a testament to its strategic approach to value creation.

BlackRock Holdings Value: Impact on Global Markets

BlackRock’s massive portfolio has a ripple effect on global markets. When BlackRock buys or sells large blocks of securities, it can influence market prices and investor sentiment. This underscores the importance of monitoring BlackRock Holdings Value to understand broader financial trends.

How to Analyze BlackRock Holdings?

Analyzing BlackRock Holdings Value involves examining its portfolio composition, asset allocation, and market performance. Key steps include:

- Reviewing SEC filings and annual reports for detailed portfolio insights.

- Monitoring its top holdings and recent transactions.

- Evaluating market trends to understand the rationale behind its investment choices.

Investment Strategies Used by BlackRock

BlackRock employs a mix of active and passive investment strategies. Its iShares ETFs, for instance, are designed for passive index tracking, while its actively managed funds aim to outperform the market. This dual approach ensures a balanced investment strategy.

BlackRock and ESG Investments

One of the key highlights of BlackRock Holdings Value is its commitment to ESG principles. BlackRock has been a pioneer in integrating sustainability into its investment decisions, emphasizing the importance of long-term value creation.

What Are the Risks Associated with BlackRock Holdings?

Despite its robust investment strategies, BlackRock is not immune to risks. Some of the challenges include:

- Market Volatility: Fluctuations in financial markets can impact its portfolio value.

- Regulatory Risks: Changes in financial regulations can affect its operations.

- Geopolitical Uncertainties: Global tensions and economic disruptions can pose challenges.

How Has BlackRock Holdings Value Evolved Over Time?

Over the years, BlackRock Holdings Value has grown significantly, driven by strategic acquisitions, innovative products, and a strong focus on client satisfaction. The firm's ability to adapt to changing market conditions has been a cornerstone of its success.

BlackRock vs. Other Asset Managers

When compared to other asset managers, BlackRock stands out for its scale, technological innovation, and ESG focus. Its Aladdin platform, for instance, is a leading risk management tool used by institutions globally.

The Role of Technology in BlackRock Holdings

Technology plays a crucial role in managing and analyzing BlackRock Holdings Value. From risk assessment tools to AI-driven investment models, BlackRock leverages technology to maintain its competitive edge.

How Can Investors Benefit from BlackRock Holdings?

Investors can benefit from BlackRock’s expertise by investing in its mutual funds, ETFs, or other products. By aligning with BlackRock’s strategies, individual investors can gain exposure to diversified and professionally managed portfolios.

Future Outlook of BlackRock Holdings Value

The future of BlackRock Holdings Value looks promising, with continued focus on innovation, sustainability, and global expansion. As markets evolve, BlackRock is well-positioned to adapt and thrive.

Frequently Asked Questions About BlackRock Holdings

Here are some common questions about BlackRock Holdings Value:

- What is BlackRock’s largest holding? As of 2023, technology companies like Apple and Microsoft are among its largest holdings.

- How does BlackRock influence global markets? Its investment decisions can sway market prices and investor sentiment due to its size and scale.

- Is BlackRock focused on sustainable investments? Yes, BlackRock has been a leader in integrating ESG principles into its investment strategies.

- Is Jules Queer

- How Many Lawyers Does Mcdermott Have

- Who Has The Greatest Voice Of All Time

- How Much Is Dolly Parton To Hire

- Who Is The Greatest Male Singer Of All Time

Visualizing BlackRock’s Top Equity Holdings Telegraph

BlackRock The company that owns the world? Infographs Dhan Community