Understanding Moore Capital Management AUM: A Comprehensive Guide

Moore Capital Management, a renowned name in the hedge fund industry, has been a key player in global financial markets for decades. Founded in 1989 by billionaire investor Louis Bacon, the firm is synonymous with strategic investment, risk management, and exceptional performance. One of the most frequently discussed metrics when evaluating the success and influence of Moore Capital is its Assets Under Management (AUM). This figure provides a tangible measure of the firm's financial clout and market significance.

For those interested in the hedge fund ecosystem or exploring the intricate world of investment management, understanding the role of Moore Capital Management AUM is crucial. AUM not only reflects the firm's ability to attract capital but also serves as an indicator of investor confidence and market reputation. With a legacy of delivering exceptional returns and navigating through volatile market cycles, Moore Capital's AUM has consistently been a subject of interest among financial analysts, investors, and industry enthusiasts.

In this article, we will take a deep dive into the significance of Moore Capital Management AUM, exploring its historical trends, factors influencing its growth, and the broader implications for the hedge fund industry. Whether you're a seasoned investor or a curious reader looking to expand your knowledge, this detailed guide will shed light on why AUM is a critical metric and how Moore Capital has positioned itself as a dominant force in the financial markets.

- Are Mason And Meg Still Together

- How Old Is Ava In Twisted Hate

- Is Maria Bartiromo Married And Have Children

- How Old Is Sandra Smith On Fox News

- Who Is Jules The Lawyers Brother

Table of Contents

- Biography and Background of Louis Bacon

- What is Moore Capital Management AUM?

- Why is AUM Important for Hedge Funds?

- How Has Moore Capital Management AUM Evolved Over the Years?

- Factors Affecting Moore Capital Management AUM

- The Investment Strategies That Drive AUM Growth

- What Sets Moore Capital Management Apart from Other Firms?

- Moore Capital Management AUM in a Global Context

- How Does AUM Impact Investor Confidence?

- The Role of Risk Management in Maintaining AUM

- Future Outlook for Moore Capital Management and Its AUM

- What Lessons Can Investors Learn from Moore Capital Management?

- Frequently Asked Questions about Moore Capital Management AUM

- Conclusion: The Significance of Moore Capital Management AUM

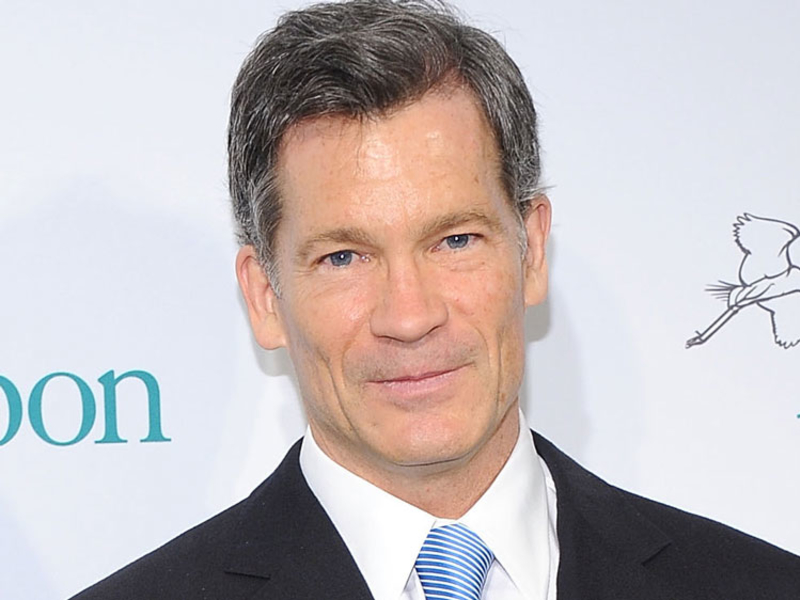

Biography and Background of Louis Bacon

Louis Bacon, the founder of Moore Capital Management, is a legendary figure in the world of finance. His journey from a floor trader to one of the most successful hedge fund managers in history is nothing short of extraordinary. Born in Raleigh, North Carolina, in 1956, Bacon attended Middlebury College and later earned his MBA from Columbia Business School.

Personal Details of Louis Bacon

| Full Name | Louis Moore Bacon |

|---|---|

| Date of Birth | July 25, 1956 |

| Place of Birth | Raleigh, North Carolina, USA |

| Education | Middlebury College (BA), Columbia Business School (MBA) |

| Occupation | Investor, Hedge Fund Manager |

| Notable Achievement | Founder of Moore Capital Management |

What is Moore Capital Management AUM?

Assets Under Management (AUM) refers to the total market value of the assets that a financial institution, such as Moore Capital Management, manages on behalf of its clients. This metric is a key indicator of the firm's size, reputation, and investment capabilities. Moore Capital Management AUM reflects the trust and confidence investors place in the firm's ability to generate returns and manage risk effectively.

Why is AUM Important for Hedge Funds?

AUM is a critical measure for hedge funds as it directly impacts their revenue, operational capabilities, and market reputation. Here’s why AUM is so significant:

- Does Jules Pass The Bar Exam

- Which Woman Has The Most Attractive Voice

- When Was Danny Devitos Last Movie

- What Caused Danny Devito To Be Short

- Are Alina And Ilias Together

- Revenue Generation: Hedge funds typically charge fees based on AUM, making it a primary source of income.

- Investor Confidence: A higher AUM often indicates strong investor trust and market credibility.

- Operational Scale: Greater AUM allows firms to invest in advanced technologies and attract top talent.

How Has Moore Capital Management AUM Evolved Over the Years?

Moore Capital Management AUM has seen significant fluctuations over the years, influenced by market conditions, investment performance, and strategic decisions. The firm has historically been known for its ability to adapt to changing market dynamics, which has contributed to its sustained relevance in the financial industry.

Factors Affecting Moore Capital Management AUM

Several factors influence the growth and sustainability of Moore Capital Management AUM, including:

- Investment Performance: Consistent returns attract more investors.

- Market Volatility: Economic downturns can lead to asset withdrawals.

- Regulatory Changes: Compliance with global financial regulations impacts AUM.

- Client Retention: Strong relationships with clients ensure steady inflows.

The Investment Strategies That Drive AUM Growth

Moore Capital employs a mix of macroeconomic strategies, including currency trading, commodities, and equities, to drive growth in its AUM. The firm's diversified portfolio and risk management techniques have been instrumental in its success.

What Sets Moore Capital Management Apart from Other Firms?

Moore Capital Management stands out due to its robust investment strategies, experienced leadership, and a proven track record of navigating complex market environments. The firm's ability to deliver consistent returns has made it a preferred choice among institutional and individual investors.

Moore Capital Management AUM in a Global Context

In the global hedge fund landscape, Moore Capital Management AUM represents a significant portion, highlighting the firm's influence and reach. Its global presence and investments across various markets make it a key player in the financial world.

How Does AUM Impact Investor Confidence?

A higher AUM often translates to increased investor confidence as it suggests stability, robust performance, and effective risk management. For Moore Capital, its AUM reflects the trust investors place in the firm's expertise and capabilities.

The Role of Risk Management in Maintaining AUM

Risk management is a cornerstone of Moore Capital's operations, ensuring the preservation and growth of its AUM. The firm employs sophisticated models and strategies to mitigate risks associated with market volatility and economic uncertainties.

Future Outlook for Moore Capital Management and Its AUM

As financial markets evolve, Moore Capital Management is well-positioned to adapt and thrive. The firm's focus on innovation, agility, and client-centric strategies is expected to drive further growth in its AUM.

What Lessons Can Investors Learn from Moore Capital Management?

Investors can learn valuable lessons from Moore Capital's approach to investment management, including the importance of diversification, risk management, and staying informed about market trends. The firm's success underscores the significance of strategic planning and adaptability.

Frequently Asked Questions about Moore Capital Management AUM

Here are some common questions about Moore Capital Management AUM:

- What does AUM stand for? Assets Under Management.

- How is AUM calculated? It includes the total market value of all assets managed by the firm.

- Why is AUM important? It reflects the firm's size, performance, and market reputation.

Conclusion: The Significance of Moore Capital Management AUM

Moore Capital Management AUM is more than just a metric; it is a testament to the firm's enduring legacy, strategic brilliance, and unwavering commitment to its clients. By understanding the nuances of AUM and its implications, investors and industry observers can gain deeper insights into the dynamics of the hedge fund industry and the factors that drive success in this competitive landscape.

- What Does Jules Inject Herself With

- Is Sean Hannity Married

- What Does Sheldon Bream Do For A Living

- Are Alina And Ilias Together

- Who Has The Most Beautiful Singing Voice

Louis Bacon Macro maestro

Moore Capital's Louis Bacon to quit money management business