What Is HR 899? Exploring A Key Piece Of US Legislation

So, you might be hearing some chatter about "HR 899" and wondering just what in the world it's all about. It's almost a common thing to come across legislative numbers, and they can be a bit confusing, can't they? Well, this particular designation, HR 899, actually points to a couple of very different, yet incredibly important, pieces of proposed legislation within the United States Congress. We're talking about bills that could really shape things for a lot of people, and that's why it's pretty important to get a clear picture of what's going on.

You know, it's worth noting that bill numbers, like HR 899, don't stay unique forever. They actually restart every two years with each new Congress. This means that an HR 899 from one Congress might be completely different from an HR 899 in another. It's a system that, in a way, keeps things fresh but can also lead to a little bit of head-scratching for folks trying to keep up. That's why context is everything when you see these numbers pop up.

For our discussion here, we're going to look at two distinct versions of HR 899 that have made headlines. One, from the 119th Congress, aims to make some big changes to the federal Department of Education. The other, from the 117th Congress and also seen in more recent proposals, deals with some pretty significant international tax rules. Both are quite impactful, and understanding each one is, arguably, very helpful for anyone following US policy.

- Who Is Sandra Smiths Husband

- Who Has The Greatest Voice Of All Time

- Is Bret Baier Married

- Did Shannon Breams Husband Have A Brain Tumor

- Jules Ambrose

Table of Contents

- What is HR 899? A Look at the Department of Education Bill

- Understanding HR 899's Role in International Tax Policy

- Frequently Asked Questions About HR 899

What is HR 899? A Look at the Department of Education Bill

When people ask "What is HR 899?", often they are thinking about a particular bill that has stirred up quite a bit of conversation regarding federal education policy. This bill is, basically, about the future of the Department of Education. It's a pretty straightforward proposal in some respects, but its potential effects are quite far-reaching for students, schools, and how education is managed across the country. It really gets people talking, you know?

The 119th Congress Version: A Bold Proposal

So, this particular bill, the one from the 119th Congress, was actually brought forward in the House of Representatives quite recently, on January 31, 2025. Its core message is, in fact, incredibly concise. It's just one sentence long, stating, "The Department of Education shall terminate on December 31, 2026." That's it. This brief statement carries a massive implication: completely ending the federal agency responsible for overseeing education policy and funding at a national level. It's a pretty direct approach, to say the least.

This proposal was, as a matter of fact, referred to the House Committee on Education and Workforce, which is the usual first step for bills like this. Republican lawmakers, it seems, have taken a key step to officially abolish the U.S. Department of Education with this move. For student loan borrowers, this could mean, arguably, very significant changes to how their loans are administered, if at all, which is something many people are wondering about. What would it mean if this department actually ended? It's a question that brings up a lot of other questions.

- How Old Is Ava In Twisted Hate

- Who Is Sandra Lees First Husband

- Did Ben And Sara Get Married

- Who Did Shannon Bream Replace On Fox News Sunday

- What Does Sheldon Bream Do For A Living

Congressman Massie, for instance, announced the reintroduction of this specific HR 899 on social media, making it clear that this effort to terminate the Department of Education is a priority for some. The idea is to remove what some see as the influence of "unelected bureaucrats in Washington, D.C." from educational matters. This bill, you know, represents a strong push to shift power and responsibility for education back to states or even more local levels, which is a major policy debate in the country.

Earlier Iterations: The 117th Congress Bill

It's interesting to note that this isn't the first time an HR 899 has aimed to abolish the Department of Education. There was, in fact, an HR 899 from the 117th Congress, which met from January 2021 onwards. This earlier version of the bill also sought to terminate the Department of Education, though its proposed termination date was December 31, 2018. That date, of course, has passed, which shows how legislative efforts can sometimes take a while, or need to be reintroduced.

This highlights the point about bill numbers resetting every two years. The HR 899 from the 117th Congress and the HR 899 from the 119th Congress are, basically, distinct legislative efforts, even though they share the same number and a similar goal. It's a bit like having two different books with the same title but written in different years, you know? Each one has its own journey through the legislative process, and its own specific timeline for consideration. Knowing which Congress a bill belongs to is pretty important for getting the right context.

Understanding HR 899's Role in International Tax Policy

Now, let's switch gears a little, because "What is HR 899?" can also refer to a completely different, but equally impactful, legislative proposal. This other HR 899 is tied into complex international tax rules and could, in a way, really change how foreign companies and investors deal with their tax obligations in the United States. It's a very different subject matter than education, but it's just as important for those it affects.

The House Bill (H.R. 1, Section 899)

On May 22, 2025, the House of Representatives passed H.R. 1, which is a very large bill often referred to as "the House bill." While this bill generally focuses on domestic taxpayers, it includes a specific provision known as Section 899. This Section 899, if it becomes law, could dramatically impact the US tax liability of foreign taxpayers. We're talking about a wide range of entities here, including foreign fund investors, sovereign wealth funds, and foreign pension funds. It's a pretty big deal for them.

This proposed Section 899 is, actually, aimed at retaliating against what are considered "unfair foreign taxes." This includes measures like the Under Taxed Profits Rule (UTPR) under the OECD's Pillar Two project, as well as unilateral measures such as Digital Services Taxes (DSTs) and Diverted Profits Taxes (DPTs). Chairman Smith, it turns out, had previously proposed Section 899 both earlier in 2025 and in 2023, showing that this is a persistent area of focus for some lawmakers. It's a way to push back against certain international tax practices that some in the US government see as problematic.

The "One Big Beautiful Bill" Act, which includes this updated version of proposed Section 899, contains some of the most sweeping changes to the tax treatment of foreign capital in the U.S. in decades. The compliance for impacted companies, should this provision be enacted, will prove difficult, especially pending revisions during Senate negotiations. So, it's not just a theoretical change; it has very real, practical implications for businesses operating across borders. It's a pretty complex area, to be honest.

The Senate's Counterpart (Section 899)

On June 16, 2025, the Senate also released its own version of a tax reconciliation package, often called "the Senate bill." This package includes a proposed Section 899 that is, in many respects, quite similar to the House version of Section 899. This similarity suggests a shared concern among lawmakers about these "unfair foreign taxes." However, there are also some key differences that are worth noting.

The Senate Finance Committee's version of H.R. 1 proposes some important changes to Section 899's "revenge tax" and BEAT (Base Erosion and Anti-abuse Tax) provisions. These changes include new exemptions, lower caps, and delayed compliance timelines. These differences are, basically, what lawmakers will be discussing and trying to reconcile as the bill moves forward. In summary, understanding these practical issues under the proposed Section 899, and pointing out the similarities and material differences between the House and Senate versions, is quite important for anyone trying to figure out the final impact of this legislation. It's a very detailed process, really.

Implications for Private Investment Funds

Private investment funds, in particular, may be significantly impacted by this Section 899. It's a new addition to the U.S. Internal Revenue Code within the "One Big Beautiful Bill" that was approved by the House of Representatives. For these funds, this means a potential shift in how they structure their investments and how their profits are taxed, especially if they have foreign investors or operations. It's a very specific concern for that part of the financial world, you know?

The rules being proposed could, arguably, create new compliance burdens and change the profitability of certain international investment strategies. So, while the broader aim is to address what are seen as unfair foreign taxes, the ripple effects can be felt by very specific sectors of the economy. It's a testament to how interconnected global finance is, and how a single legislative section can have such a wide reach. It's quite a complex situation.

Frequently Asked Questions About HR 899

People often have questions when it comes to legislative matters, and HR 899 is no exception. Here are a few common queries that come up, especially given that there are different bills sharing this number. It's just a little bit confusing, isn't it?

What is the main purpose of HR 899?

Actually, there are two main purposes depending on which HR 899 you are referring to. The HR 899 from the 119th Congress is primarily aimed at terminating the federal Department of Education. The other prominent HR 899, often found as Section 899 within larger tax bills like H.R. 1, focuses on retaliating against what are considered unfair foreign taxes, such as digital services taxes and under-taxed profits rules. So, it really depends on the context.

Has HR 899 become law?

As of the information available, neither version of HR 899 has become law. For a bill to become law, it must be passed by both the House of Representatives and the Senate in identical form, and then it needs to be signed by the President. The HR 899 aiming to end the Department of Education was introduced and referred to committee. The Section 899 related to taxes has passed the House as part of H.R. 1, and the Senate has released its own version, meaning negotiations are likely still ongoing. So, there's still a journey for these bills.

Why are there different bills with the number HR 899?

This happens because bill numbers, like HR 899, restart with each new two-year session of Congress. For example, a bill introduced in the 117th Congress might have the number HR 899, and then a completely different bill introduced in the 119th Congress could also be assigned the number HR 899. It's a system designed for each Congress to have its own numbering sequence, but it can, you know, sometimes cause a little bit of confusion for the public. It's pretty important to always check which Congress a bill belongs to for clarity. You can learn more about legislative processes on our site, and also find details about specific bills on a resource like a reputable government source.

- What Does Jules Inject Herself With

- What Does Stella From Twisted Lies Look Like

- What Is Jules Deployment

- Is Jules A Lawyer

- Judge Jules Songs

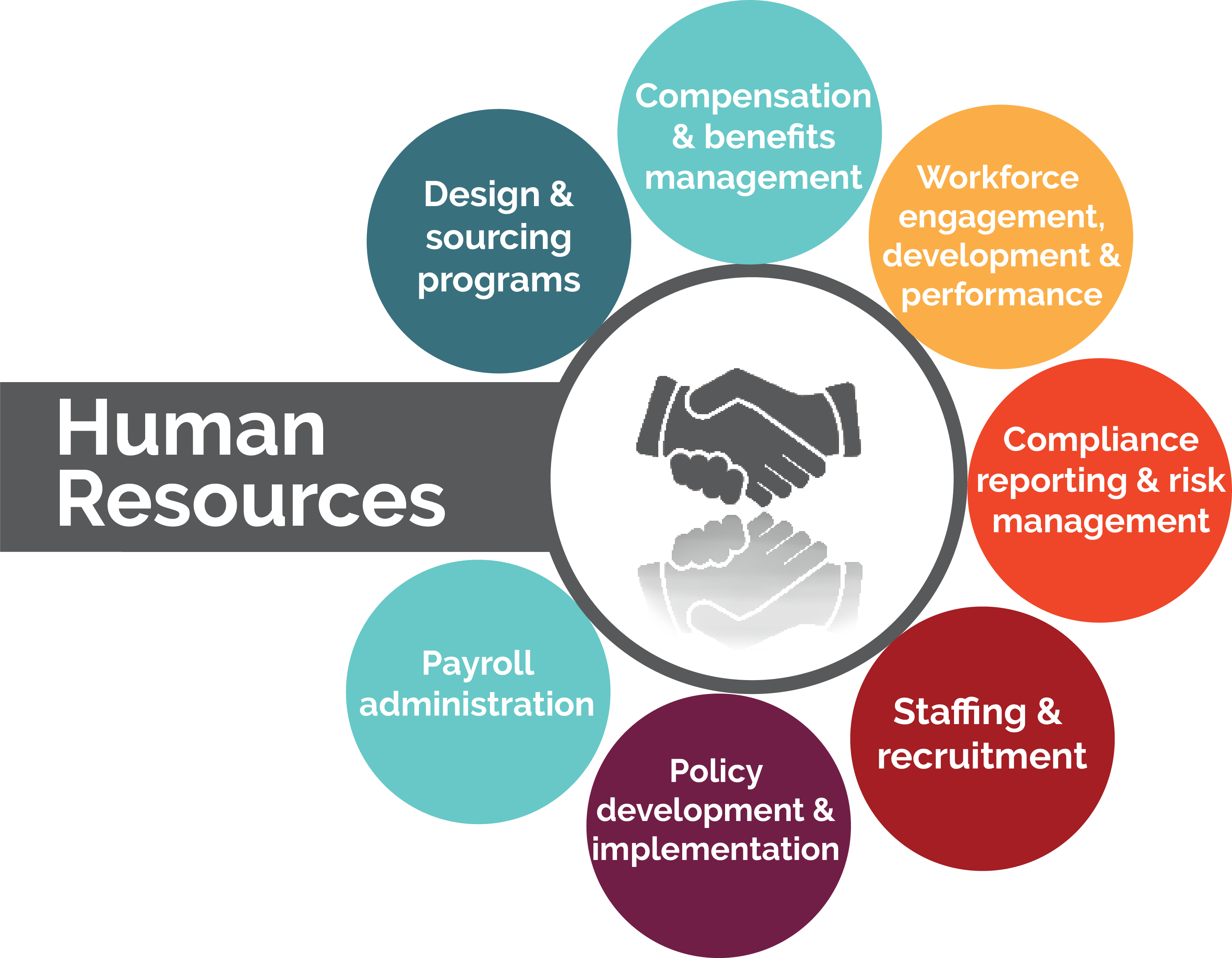

What is Human Resource Management and Why it is Important?

HR Generalist Course - Protouch

What Does HR Do? 5 Frequently Asked Questions about HR - AIHR